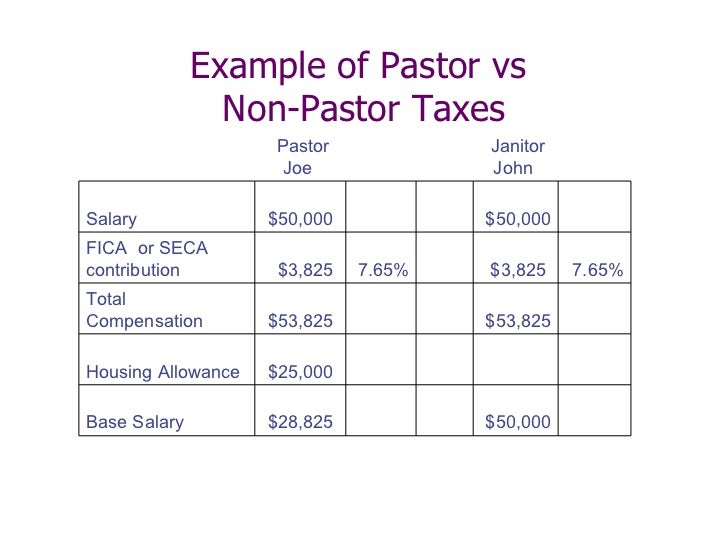

Example Of Pastors W2

You may need to ask your treasurer for a corrected W-2. If your salary is 37500 and the housing allowance is 2500 for a total compensation of 40000.

Https Www Westohioumc Org Sites Default Files Conference Documents Pdf Page 2020 Clergy Example W2 0 Pdf

Service lived in a church parsonage furnished by her church and.

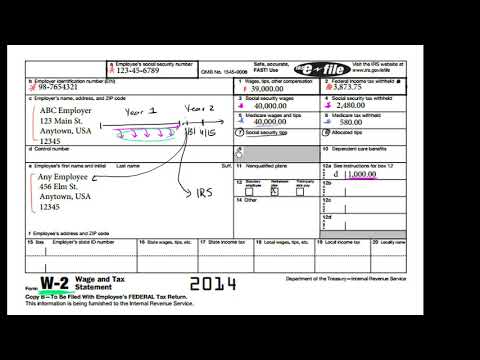

Example of pastors w2. If your employees give their consent you can furnish Forms W-2 to your employees electronically. Example of Form W-2 for Clergy Rev. This box should be empty on a clergy W-2.

Smith is provided a parsonage and the church pays a 1500 housing parsonageutility allowance to his pursuant to an estimate of such expenses and a properly adopted. Smith has a salary of 25000 from the local church. Unique W-2 Issues that are more relevant for churches and ministers are highlighted in the notes below.

For additional information refer to Publication 517 Social Security and. Even though a minister receives Form 1099-MISC he or she may be an employee who should receive Form W-2. Clergy default to 0 unless optional withholding is set up with the church.

Therefore if a voluntary withholding agreement does not exist a pastors income should be reported on Form W-2 as follows. On a W-2 form do NOT include a sign or commas. Posted at 0200h in Clergy by Robert Hernandez Share From a personal income perspective the first thing to understand is that the income tax code takes the position that any money paid to or for an employee is income unless specifically excluded by the tax code.

Completing an IRS W-2 sample form for Rev. For details on furnishing W-2s in this format see chapter 11 in my Church Clergy Tax Guide. DO include decimal point and cents even if 0.

She received a cash salary of 40000 from her church. Sue Service serves as pastor of a local United Methodist church. Do Not include the pastors Housing Resolution in ox 1 and ox 16.

1000 was withheld from the pastors wages and put in a 403 b plan leaving salary of 19000. She is provided a parsonage and pursuant to an estimate of such expenses and a properly adopted resolution the church pays her an additional 1500 parsonage utility allowance. Box 1 is 37500 Box 14 is 2500.

The 6000 is a Social Security Allowance and is fully taxable to the recipient. Example Of Form W2 For Clergy Housing Allowance 2018 Whenever you file taxes you will need to make use of a W2 form to keep monitor of the amount of earnings and costs that are becoming noted to the IRS. Although W-2s are not difficult to prepare there are some tips you should know.

The IRS takes the position that few ministers are independent contractors - ministers employed by a congregation for a salary are generally employees. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. Including housing resolution HSA FSA.

Example of Form W-2 for Clergy This is an example of how to fill out a Form W-2 for Rev. Why isnt the HA 6000 subtracted from salary when calculating the amount for Box 1. Box 12 is to be used to show codes and amounts of benefits or contributions for clergy.

They must pay social security and Medicare by filing Form 1040 Schedule SE Self-Employment Tax. Total cash paid to pastor should be reduced by tax-deferred items. Traveling evangelists for example may be independent contractors.

Hannibal MO The church paid the pastor 20000 in wages and 10000 in housing allowance. Following the notes is a sample W-2 Form for a Minister. Clergy W-2 wages not subject to Social Security.

403 b reporting on W-2. Members of the Clergy. Its indicated elsewhere that it should be.

This box should be empty on a clergy W-2. First be sure to add cents to all amounts. Clergy W-2 wages not subject.

Box 1 should indicate the pastors salary minus hisher qualifying housing allowance. 1000 would be reported on the W-2 as 100000. This parsonage allowance is not included as income in.

Please advise us on how to complete the pastors W-2. Service has a salary of 25000 from the local. During the preceding year Rev.

Federal taxes withheld from paycheck. Medicare is not withheld. See the IRS Form W-2 instructions for a complete list of codes The following codes are the most relevant for clergy.

Doe has a salary of 45000 from the congregation. Form W-2 Reminders For Clergy Box 1 16 Wages includes the health allowance. Boxes 3 4 5 and 6 should be left blank since the pastor is responsible for withholding and paying his or her own taxes.

However if a pastor is a participant in some other non-qualified plan amounts may need to be reported here. A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14. By using a W2 Form you are able to track all the financial information that is being noted to the IRS on a monthly quarterly or yearly basis.

How To Prepare W 2s For Church Employees Including Ministers Church Law Tax

Intro To The W 2 Video Tax Forms Khan Academy

Expense Reimbursement Form Templates 17 Free Xlsx Docs Pdf Samples Templates Creating A Newsletter Email Newsletter Template

Churches Payroll Taxes To Pay Or Not To Pay

Payroll Tax Forms 941 For Churches

What Reports Do The Church Need To File With The Government Regarding My Compensation Ministrycpa

Sample Teacher Evaluation Form Example Teacher Evaluation Evaluation Form Teaching Process

Explore Our Example Of Resignation Letter For Call Center Resignation Letter Sample Resignation Letter Letter Templates

Understanding Your Tax Forms Form W 2 Wage And Tax Statement W2 Forms Tax Forms Tax Time

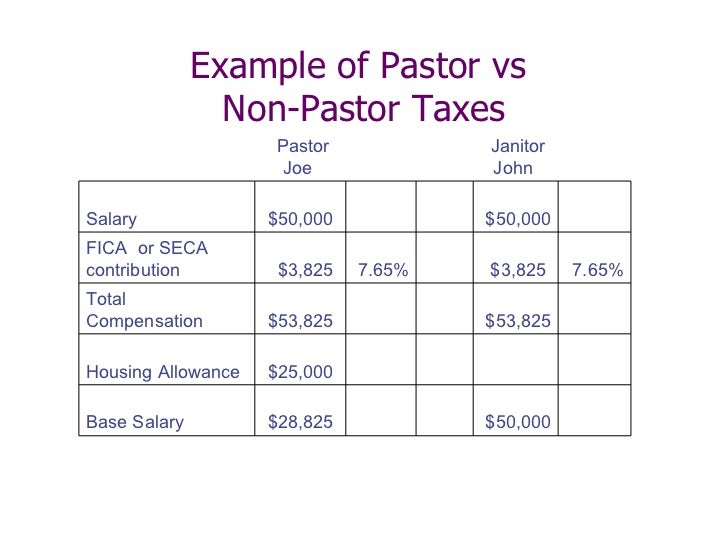

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

006 Id Card Template Word Ideas 1920x1920 Employee Microsoft In Employee Card Template Word Professional Templa Employees Card Id Card Template Card Template

Access Denied Internal Revenue Service Lost Employer Identification Number

Designating All Salary As Housing Allowance

Comcast Bill Sample Bill Template Comcast Play Money

What Reports Do The Church Need To File With The Government Regarding My Compensation Ministrycpa

Street Smart Finances For Covenant Pastors 2012

Pin On Biblical Prophecy And The End Times

What Income Should Be Included On A Pastor S W 2

Post a Comment for "Example Of Pastors W2"